21901 NE Halsey St. Ste 203, Fairview, Or. 97024

info@trevinwebbinsurance.com

(503) 667-2820

Having the right life insurance is pivotal in planning for the future of you and your loved ones. Life insurance can help you fulfill promises you’ve made your family when you are gone.

Don’t leave the future of you and your loved ones to chance. Trevin Webb Insurance Agency can help you find the right life insurance coverage for you, and help ensure that your policy continually meets your needs. Click here to help understand the difference between Term Life and Permanent life insurance

The right life insurance will be unique and dependent on personal and financial needs. As your life changes, your life insurance coverage may need to change in order to adapt to your current needs. Some life transformations that may require a policy “tune-up” include:

Having the right life insurance is pivotal in planning for the future of you and your loved ones. Life insurance can help you fulfill promises you’ve made your family when you are gone.

Don’t leave the future of you and your loved ones to chance. Trevin Webb Insurance Agency can help you find the right life insurance coverage for you, and help ensure that your policy continually meets your needs.

The right life insurance will be unique and dependent on personal and financial needs. As your life changes, your life insurance coverage may need to change in order to adapt to your current needs. Some life transformations that may require a policy “tune-up” include:

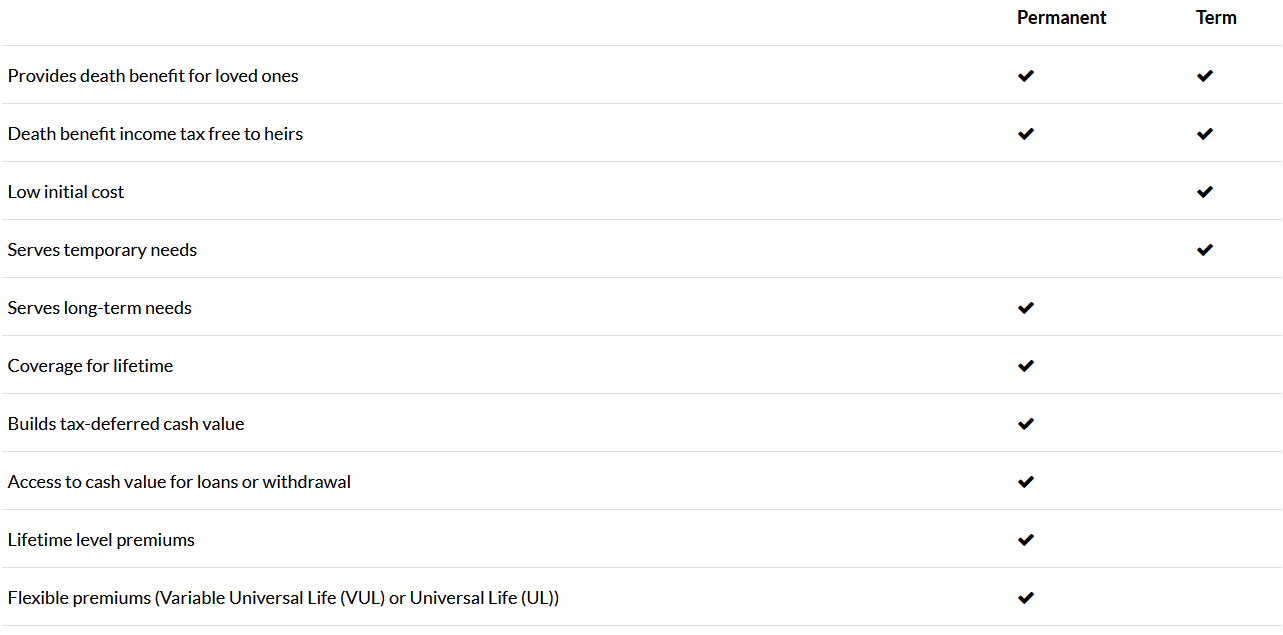

The Trevin Webb Insurance Agency can help you select the best life insurance coverage for your needs. There are several different types of life insurance products available and the decision can be over whelming. First you just need to know the basics then sit down with one of our professionals at the Trevin Webb Insurance agency to determine what fits your family’s needs the best. – You’ve heard Term & Permanent but what does that mean? Below is how I like to break down the difference’s between Term and Permanent Life insurance.

Term life insurance is the kind of like renting an apartment. Renting/ Term Insurance: You sign a contract for a set time period (called a term) which is typically 10 years, 20 years, or 30 years. Renting Term Life insurance is usually inexpensive, especially in comparison to some of the other life insurance options. At the end of the term, the insurance either runs out or you will have to sign a new term contract. If you are able to sign a new term contract it will be more expensive because you are 10, 20 or 30 years older than when you signed the original contract or if you have any health conditions that are different than you had the prior contract ( health issues etc.). After your term expires, your age has changed and possibly your health has too. Best case scenario, your still in good health after 20 years (or 30) when your term life insurance expires and if you need another term you can get it. So I usually find that even after 30 years clients still need something however, it usually is less coverage than what then needed prior to being 50 years of age (mortgage is paid off, Cars paid off, getting close to retirement, kids out of school etc.) however they still need it for final expenses as there seems to be some kind of debt or loss of income should one of the bread winners pass away early (Partner doesn’t retire till age 65 etc).

The Second type is called a permanent life insurance and to explain Permanent life insurance, (I use the analogy of purchasing a house). When you purchase a house you get a whole list of benefits that renting an apartment doesn’t have. The house is yours. You own it. If you want to paint it in a zebra pattern, you have that ability. If you want to put bars on the windows, go for it. As long as you make the payments, that house belongs to you and the price won’t change. The house will build cash value, you can borrow against it (like a second mortgage) and the house is listed as an asset on any ledger sheet. Here’s the thing, typically, buying a house is more expensive than renting an apartment. The house is more expensive and there are other financial consideration to keep in mind such as lawn up-keep, trash pick-up, not to mention big ticket expenses like replacing the roof or purchasing homeowners insurance etc. Purchasing a house is the best option for some people, even though the cost is considerably higher, in most cases, than renting an apartment. The Benefits are worth the cost to them. Note: of course there are different types of permanent policies such as Whole life, Flexible universal life, Variable life, and Index universal life. They are all permanent however, different in many ways in regards to their “bells and Whistles”. As in the book:”Juror number one” (that goes into this more) long and short of it the benefits can be tax free growth (such as a Roth IRA), lock in gains every year (so you don’t loose your gains), allows for access of your money for any reason, at any time and at any age without penalty; Allow you to keep your money invested for as long as you like without penalty; provide a large, income-tax free, payment to the person of your choosing if you died prematurely and can help you retire tax free (More below on this if interested).

What type of life insurance is best for you? Talk with the team at Trevin Webb Insurance. We can assist in identifying the best protection for you.

Having the right life insurance is essential to planning for your present and your future. Not only can life insurance provide assurance for your family after you are gone, many life insurance options offer other benefits and investment opportunities you can take advantage of while you are living.

Life Insurance Death Benefit – When you pass away, your life insurance provides income (tax-free) to your named beneficiary or beneficiaries that can be used to pay funeral expenses, debt, tuition, estate taxes, or virtually any financial need. Your policy can help provide security for your business as well, by enabling partners to buy out the interests of a deceased partner and prevent a forced liquidation.

Living Benefits – The cash value growth of a permanent (whole) life insurance policy is tax-deferred, meaning you do not pay taxes on the growth of cash value, unless money is withdrawn. Loans or withdrawals can be taken against the cash value of a permanent life insurance policy to help with expenses, such as college tuition or the down payment on a home.

The right life insurance coverage for each and every one of our customers is unique. Talk with the Trevin Webb Insurance team today to find out how to protect your family and your future with the right life insurance.

Having the proper insurance package is one of the most important decisions your family can make. That’s where Trevin & his team can help. Helping families like yours isn’t a job, it’s a commitment.

The Trevin Webb Insurance Agency can help you select the best insurance coverage for your needs. There are several different types of insurance products available and the decision can be overwhelming.